Comprehensive Somaliland Economy Sector Guide By SomalilandBIZ

Livestock is the foundation of Somaliland’s economy and the objectives of this Sector Guide includes the following:

a) Provide a historical overview of Somaliland’s livestock sector

b) Provide the key statistics and data points for Somaliland’s livestock sector

c) Provide an overview of the key players in the livestock sector

d) Offer an overview of the regulation governing Somaliland’s livestock sector

e) Outline the key challenges facing the livestock sector in Somaliland

f) Identify future opportunities in Somaliland’s livestock sector

Sponsor

If you are interested in sponsoring our Sector Guides, please get in touch regarding sponsorship opportunities.

- Sector employs 70% of the population

- Contributes to 60% of GDP

- Makes 85% of foreign export earnings

- Sool, Sanaag and Togdheer regions account for 75% of all livestock

- Sheep and goats account for 91% of all animal exports

Table of Contents

1. Introduction

1.1 General background and introduction to the Livestock industry in Somaliland

The most important sector in Somaliland is livestock production which is predominately pastoral and agro-pastoral in Somaliland employing over 70% of the population. Livestock is the major export of Somaliland accompanied by its byproducts i.e. hides and skins while the country heavily depends on imports of food, fuel and manufactured products.1 Livestock production in Somaliland contributes to 60% of GDP and around 85% to foreign export earnings (Somaliland National Development Plan, 2012 – 2016). Based on 1998 FAO estimates of livestock numbers and past growth rates, Somaliland has about 1.69 million camels, 0.40 million head of cattle, 8.4 million goats and 8.75 million sheep in 2011. The Sool, Sanaag and Togdheer regions account for about 75% of all livestock. This is still the case in 2018 for Somaliland’s economy. Somaliland’s major livestock exports are sheep and goats, accounting for 91% of all animal exports. In 2010 a total of 2.352 million shoats were exported through the Berbera port (including from Ethiopian sources). Of this total, 1.612 million (69%) were exported between September and November for the Hajj festivities. Assuming an average export price of US$70, the estimated total value would be over US$160 million. Somaliland, and to a certain extent the other exporters from the Horn of Africa, depends on only a few countries for exports. For instance, of the 2.585 million head of sheep and goat exported through the Port of Berbera in 2010, about 78% went to Saudi Arabia, 20% to Yemen and the rest to Egypt and Oman.

1Somaliland Trade, Exports and Imports: An Overview. Developing Country Studies. Vol.6, No.12, 2016 (PDF Download Available). Available from: https://www.researchgate.net/publication/307513306_Somaliland_Trade_Exports_and_Imports_An_Overview_Developing_Country_Studies_Vol6_No12_2016

1.2 History of sector – livestock intertwined with culture

Historically, livestock production and pastoralism are the bedrock of Somaliland’s economy. Indeed, livestock played aa prominent role in Somaliland’s history where there was no centralised political authority and governance was based upon customary law (xeer). Disputes were often resolved through arbitration and negotiation between families and clans. The dominant mode of economic production was nomadic pastoralism: families migrated with their herds to where pasture and water could be found. The living standard of nomadic pastoralists was (and still is) almost wholly dependent upon the natural resources that support their livestock. It is for this reason that the cyclical droughts that take place in Somaliland’s regions devastates the economy annually. Although a smaller proportion of the population are pastoralists today, they still make up around 35% of the population.

1.3 Role of Livestock in Somaliland

Livestock plays a crucial role in Somaliland’s economy. Among rural communities in Somaliland, livestock still serves as the primary exchange market where sheep, camels and cows are bartered. An example of the importance of Livestock can be found in the large outdoor Livestock market in Hargeisa funded by the European Union and considered one of the largest livestock markets in East Africa. With increased investment, smart regulation, infrastructure development and sector coordination, Somaliland has ample opportunities to capitalize on the growth of the livestock sector in the Middle East and other regions of the Muslim world, while supporting its own growing local demand.

Hargeisa outdoor livestock market (Source: Veronique Lorenzo, EU Ambassador)

2. Sector in Numbers

Figure 1: Number of Livestock (heads) exported from Berbera to Arabian Gulf states from 2004 to 2012

(Source: Somaliland Ministry of Livestock)

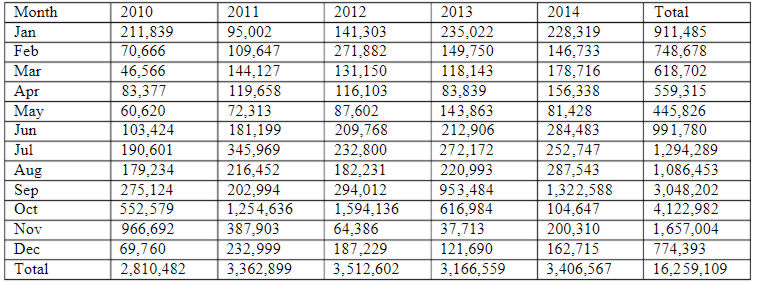

Figure 2: Total livestock exports through Berbera Port: 2010 – 2014 (heads)

(Source: Somaliland Ministry of National Planning and Development)

Livestock is Somaliland’s main export product with a large portion of its export earnings coming from the sale of livestock. After the Saudi Arabian ban on Somaliland’s livestock was lifted in 2009, exports in Somaliland grew rapidly in the following years. For example, between 2009 and 2011 livestock exports more than doubled. In the meantime, livestock exports have fluctuated between 3 and 3.5 million animals exported each year as can be seen in Figure 3 below. Figure 3 shows the annual livestock exports through Berbera Port, which is the principal port for Somaliland’s livestock exports as well as the main entry point for imports. Berbera Port is strategically located on the southern coast of the Gulf of Aden and well connected to the capital Hargeisa as well as to other regions of Somaliland. In 2017, UAE-based DP World agreed to invest $422 million to upgrade and modernize Berbera Port aswell as create the long fabled “Berbera Corridor”. Analysts now expect this move will strengthen Somaliland’s livestock sector as exports will increase exponentially as the investment will mean that Somaliland’s Berbera Port will be able to significantly increase operations.

Somaliland’s livestock market is disproportionately affected by the policies of key export markets such as the Kingdom of Saudi Arabia which it exports to for the busy Hajj season. In 2016, the Kingdom banned livestock exports from both Somalia and Somaliland due to an unknown illness among livestock. However, in July 2017, Saudi Arabia lifted the ban and Somaliland was able to resume exporting millions of sheep and goats for the busy Hajj season in Saudi Arabia.

Figure 3 – Somaliland’s Livestock Exports – Livestock Annual Units (2007-2015)

(Source: Berbera Port Authority)

Figure 4 below conveys how Somaliland’s livestock exports are seasonal. Peaks represent the annual Hajj season in Saudi Arabia where worshippers sacrifice goats for the Eid festival.

Figure 4 – Somaliland’s Livestock Exports – Monthly Goat and Sheep Units

(Source: Berbera Port Authority)

Somaliland has been suffering from high levels of inflation and currency depreciation for the last few years. This has meant that although the amount of livestock exported has remained relatively constant, export earnings are estimated to have fallen due to the depreciation of the Somaliland shilling against the dollar.

For example, if we take livestock prices from the Food Security and Nutrition Analysis Unit (FSNAU) for the month of the Hajj in each year, we have estimated that dollar earnings from livestock exports through Berbera Port peaked in 2014 at around USD 375 million but fell to around USD 280 million in 2015. This fall in livestock export earnings may indicate falling demand due to changing consumer preferences and/or the condition of Somaliland livestock.

Figure 5 – Somaliland’s Livestock Exports (Current USD)

(Source: Berbera Port Authority)

3 Sectoral data

3.1 Types of Livestock and production

Livestock is critical for Somaliland’s economy in many ways, for instance meat and milk domestic consumption, household savings and trade, including livestock exports and hide and skins. The main animals raised in Somaliland are goats, sheep, camels and cattle. Most of the pastoral cattle graze on free-range low-quality forage and non-supplementary feeding which is provided. However, with the increasing number of livestock in peri-urban and urban areas as well as with the implementation of quarantine facilities for export animals and feeding systems during shipment, the fodder supply value chain is becoming an increasingly important investment. Fodder scarcity is understood to have had a direct impact on livestock production in terms of the last few cases of droughts.

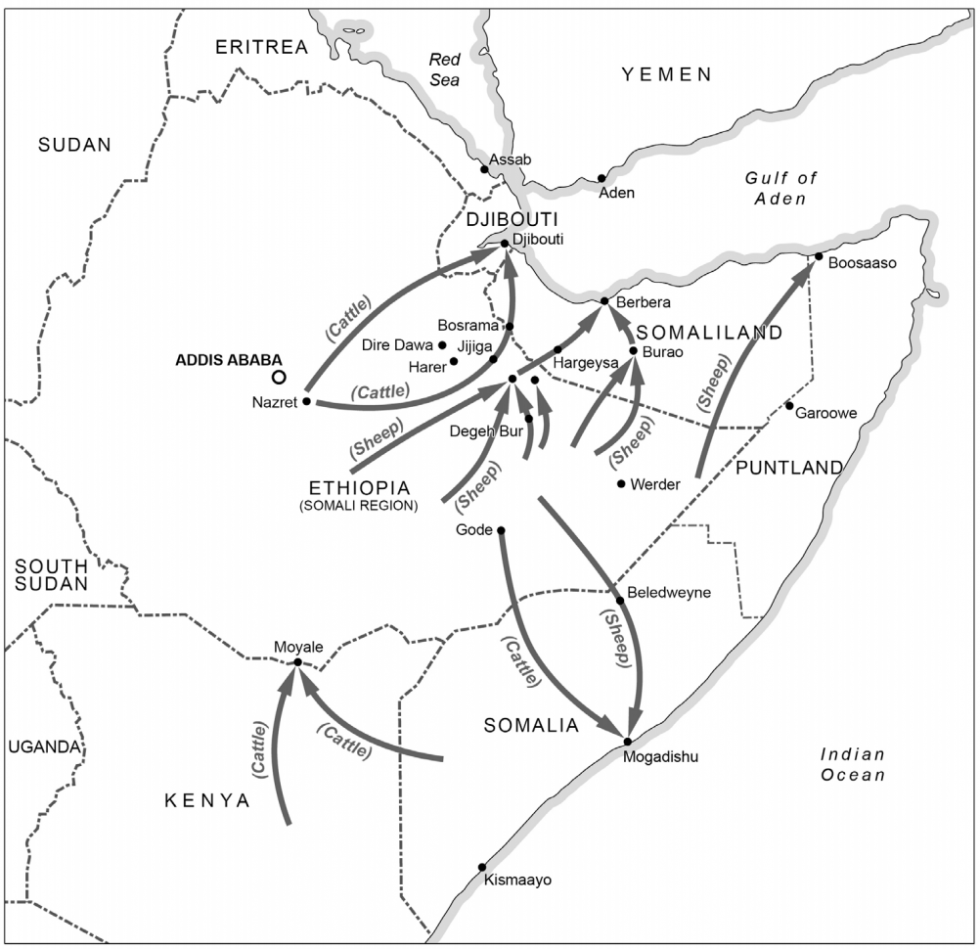

3.2 Livestock export patterns vis-à-vis Somaliand

(Source: FAC Working Paper 75.)

Livestock trade between Ethiopia and Somaliland is concentrated in Togwachalle, a town located on the border between Ethiopia and Somaliland.

Before 2010 it was one of the largest livestock markets in Somali Region operating each day of the week. In 2006, due to the massive number of livestock traded in the area, a modern livestock market centre was built. Nowadays animals are taken to the other side of the border and trading takes place inside Somaliland before animals are moved towards Hargeisa and Berbera. The border area is arid, with limited pasture and water. A vibrant fodder trade has developed over the years to sustain livestock during the long trek to Hargeisa and Berbera so that they fetch a good price. In early 2010 the Ministry of Agriculture of Ethiopia circulated a letter prohibiting the movement of any fodder beyond Jigjiga town.

3.3 National consumption patterns

Somaliland’s domestic consumption stood at around half a million units of livestock in 2016, as shown in Figure 6 below.

Livestock consumption in Somaliland

(Source: Ministry of Livestock)

3.4 Export market overview

Figure 7: Export destination markets

(Berbera Port Authority, Data based on Jan-Aug 2000 figures)

As Figure 7 above conveys, during times when there has been no livestock import ban, one of the most striking features of Somaliland’s livestock exports has been its dependence on a single destination market: Saudi Arabia. Approximately 95% of all livestock exported by Somaliland in 2000 was destined for markets within Saudi Arabia (see Table 3). Roughly 98% of all sheep and goats and 85% of all camels went to Saudi Arabia. Yemen imported 93% of Somaliland’s cattle exports, reflecting the effect of the cattle embargo imposed by Saudi Arabia in 1983. However, it is well known that many of the cattle exported to Yemen end up in Saudi Arabian markets via “back door” channels, or are exported to other Peninsula countries, including primarily Oman and the United Arab Emirates. These markets are insignificant, accounting for less than 6% of all livestock exports.

One of the chief driving forces of Saudi Arabia’s high demand for livestock is the demand for livestock associated with both Eid al-Fitr, the feast celebrated at the end of Ramadan (the Muslim month of fasting), and the holy pilgrimage to Mecca, Haj. These two religious events in Saudi Arabia attract tens of thousands of Muslims each year from around the world. The consumption of sheep and goats during this time is significant. Livestock must be imported alive, so they can be blessed and slaughtered according to Islamic law prior to consumption. Livestock exports are highly cyclical with their peak falling during the 70-day period between Eid al-Fitr, and the start of the Haj, or Eid al-Adha. The inherent risks and vulnerability created by dependence on a single market for livestock exports are emphasized by the debilitating impact of the livestock bans over the years in 2000 and as recently as 2016.This dependency, however, is due not so much due to choice as to a lack of viable alternatives.45 There is no other foreign market as ideally suited for Somaliland’s livestock as Saudi Arabia. The unique annual pilgrimage to Mecca in Saudi Arabia guarantees annual peak demand for live animals; additionally, the Saudi port of Jizan is close to Berbera, making it an ideal destination for the export of live animals.

3.5 Dairy production

With regards to milk production, the vast majority of milk produced in the country comes from camels, which is estimated between 50-60% of the total production; cattle milk contributes between 30-40% and lastly goats and sheep milk with the remaining 10%. Production of camel milk has been estimated approximately 900-1100 kilograms per lactation. Dairy cattle have a milk production per lactation estimated at 500-600 kilograms for indigenous cattle herds in semi-intensive regimes and at 200-250 kilograms for indigenous cattle in pastoral areas – European-indigenous hybrid breed cattle can produce up to 1,500-1,800 kilograms per lactation. Nomadic groups rear mixed camel heard for milk production, continually migrating in search for water and pasture. Semi-sedentary agro-pastoralists, mostly found in the western regions of the country are responsible for rearing dairy cattle. There are also pockets of more specialized dairy products, increasingly located in peri-urban areas. With increased urbanization, the demand for milk and other dairy products is likely to increase. Despite of the domestic production of milk and other dairy products, the country still imports fresh and powder milk. In 2013 it is estimated around 3.4 million litres and 4.6 million kilograms respectively.

Fodder production contributes directly to increased body weight and finishing of livestock, thus creating a value-added final product. Currently, fodder availability is unreliable, which drastically affects the finishing of the livestock. This, in turn, affects the final price of the livestock for export-oriented markets. Demand for fodder consumption at domestic as well as for export-oriented markets are usually sourced from Ethiopia.

3.6 Hide and Skins

Figure 8: Hide and skin exports through Berbera Port 2010 – 2014

(Source: Somaliland Ministry of National Planning and Development)

4 Key Players in Somaliland’s livestock sector

4.1 Key players Somaliland’s livestock market

Indha Deero Company

Based in Togdheer region, Indha Deero is one of Somaliland’s largest traders and exporters of livestock. In 2005-06 the company was estimated to be worth over $280 million. Indha Deero Group has successively exported livestock from across Somaliland and parts of Ethiopia and Somalia and as such is considered the market leader in Somaliland’s livestock sector. Since the death of its eponymous founder in 2005, the company has faced growing competition but still maintains its sizeable market share.

Emerging companies in Somaliland’s livestock market

In the last decade, Somaliland has witnessed a flourishing of livestock-based companies founded by its influential Diaspora. Below are some of the examples;

Mandeeq Poultry Company

Mandeeq Poultry Company (“Mandeeq”) was established in Hargeisa in 2015 and is the only large-scale poultry farm in Somaliland. It sells fresh wholesale eggs, feed, and chickens to local Somaliland markets, where all other competitors import their products. Mandeeq is the sister company to Mandeeq slaughterhouse, the only slaughterhouse in Hargeisa. After a year of proven operations and sales, Mandeeq aims to expand its operations to meet the local demand for fresh poultry products.

To increase production, Mandeeq will expand its operations by an additional 18,000 egg-producing chickens. The investment will also enable Mandeeq to install an additional commercial flock house as well as feed processing equipment and storage facility, which will enable the Company to blend a specific ratio of feed and supplements.

Rays Sheep and Goat Fattening Farm

Founded in 2012, Rays Sheep and Goat Fattening Farm (“Rays Farm”) is a livestock operation located in the Awdal region of Somaliland. Livestock is one of the dominant sectors of the Somaliland economy. Approximately 70% of the population is involved in animal husbandry, either as nomadic pastoralists (dominant in rural communities), agro-pastoralists, or in the livestock value chain. Sheep and goat meat is favored by most of those in Somaliland, Djibouti and Saudi Arabia and is a major component of their daily diet. However, livestock production is characterized by poor productivity and scarce animal feed,and is aggravated by reoccurring droughts and environmental degradation. Recognizing these challenges, Rays Farm saw an opportunity to create a business that produces animal feed, fattens livestock, and breeds livestock. It is the first of its kind to be established in the Awdal region. Rays Farm with 100 sheep and goats and three different farms. Rays Farm purchased new farmland, procured an additional 700 heads of sheep and goats, and built a shaded area for the cattle. Once the animals are fattened, they are sold locally or exported to Saudi Arabia.

Waayeel Camel Dairy

Waayeel Camel Dairy (“Waayeel”), established in 2014, is a dairy production business which sells camel milk and male calves to the local markets in Burao, Somaliland. Burao is a regional hub for livestock trading and slaughtering, providing sufficient demand for Waayeel’s male calves. The company also delivers fresh milk to its customers at a kiosk in Burao and has a growing and loyal customer base for its dairy products.

Wayeel’s was able to increase its revenue by expanding its production capacity, and to increasing its supply of camel milk. Waayeel Camel Dairy’s output more than doubled and its operations were made more efficient through the purchase of farm equipment and infrastructure upgrades.

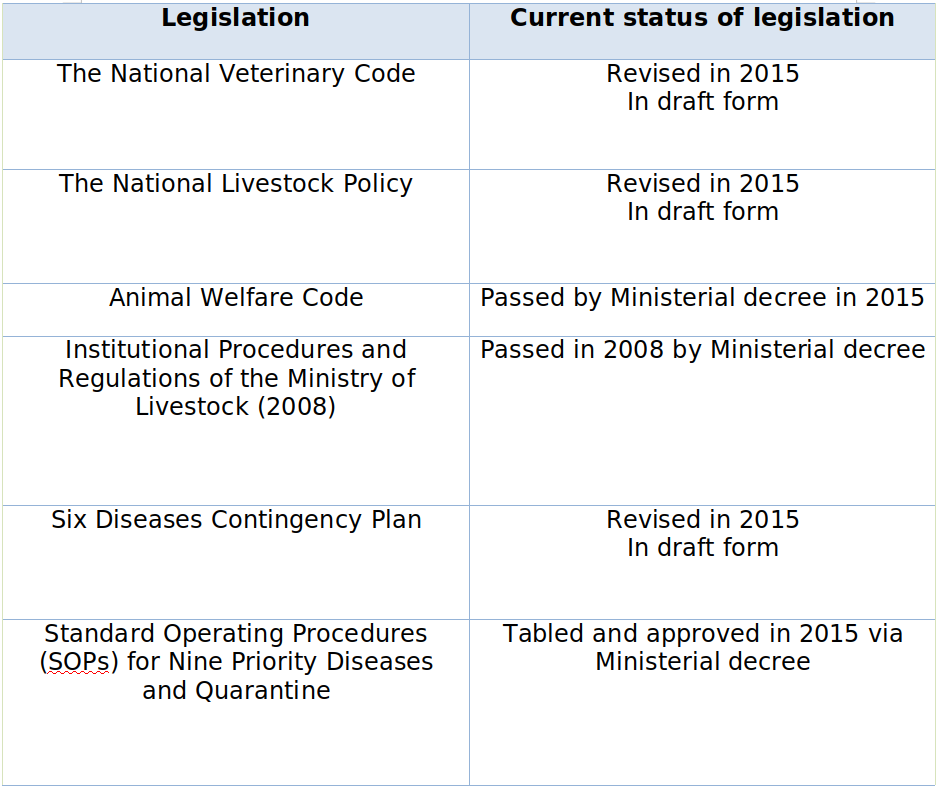

5 Regulatory framework and Economic Policy

5.1 Regulation

The introduction in 2008 of the Somaliland Veterinary Code – Law No. 34/2006 & 2008 provided a regulatory framework which meets international standards and particularly those of the OIE – Office Internazionale des Epizootique (World Organisation for Animal Health) – Codes and Standards. The Somaliland Ministry of Livestock started implementing the Somaliland Veterinary Code in its draft form (the bill was in preparation since 1997)1

5.2 Somaliland Livestock Legislation / Regulatory Matrix

5.3 Government economic policy vis-à-vis Somaliland’s livestock sector

According to the latest Somaliland National Development Plan (2017-22) statistics indicate that Somaliland has a large trade deficit that is primarily financed through aid and remittances. More worryingly, Somaliland’s exports are heavily concentrated in both products and markets, with livestock accounting for the vast majority of export earnings. Somaliland’s foreign currency reserves are also heavily influenced by its livestock sector as the vast majority of livestock exports are sold to Saudi Arabia. This is because livestock is Somaliland’s primary export product with a large portion of Somaliland’s export earnings coming from the sale of livestock to Gulf countries in exchange for liquid cash in USD currency.

6 Challenges

6.1 Urban to rural migration patterns

Somaliland’s urban-rural migration rate has seen an increase in recent years. This has had an adverse impact on the urban unemployment rate aswell as the rural poverty rate. Somalilander’s that leave rural regions to come to the city often consist of unskilled labour and consequently this exacerbates the urban unemployment rate. In reality, Somaliland’s economic future hinges on its ability to feed itself as most of its food stuff are imported from overseas markets such as Yemen and the UAE. Somaliland’s government should therefor focus on encouraging skilled labour to engage in the livestock sector via investment and enterprises. The government can do this through an array of policies such as tax breaks, subsidies to farmers and institutional support from the Ministry of Livestock which needs to be further empowered.

6.2 Droughts

In the last decade, due to climate change, Somaliland has borne the brunt of debilitating, chronic droughts that decimates Somaliland’s livestock sector. This has had a damaging impact on the health of livestock herds and, for the pastoralists that raise them, a major fall in incomes as well as an explosion in hunger and mortality rates. The drought has had a detrimental direct impact on those who are engaged in agricultural production. It has also had an indirect impact on those working in the non-agricultural sector through reduced economic growth and higher inflation in Somaliland’s currency.

Somaliland’s cyclical droughts have led to severe reductions in the quantity and quality of grazing pastures and water available for livestock. The effect on livestock herds has been devastating. Some regions have seen herd sizes fall by over half due to death, distress selling and lower birth rates. As a result, some families have lost their entire herd due to successive droughts. Even where livestock are able to survive the drought, their health and weight has been severely reduced due to a lack of available pasture and water. The weak condition of livestock reduces their prices. For example, the price of a goat in Sanaag has fallen by over 70%. This has led to a collapse in the incomes of the already poor farmers in the rural hinterland in Somaliland. Around half of the population are pastoralists and livestock plays a crucial role in supporting their livelihoods. They are a source of income and calories as well as a major capital asset. For many pastoralists, livestock are the only asset they own. Their living standards are intimately connected with the health of their livestock. As the drought has reduced the health of their livestock, it has reduced the income and ultimately, the calories pastoralists are able to consume leading to rising food insecurity, hunger and malnutrition. Many pastoralists have had to take on debt, where available, to meet urgent consumption needs.

Like other governments throughout Less Economically Developed Countries (LDC’s), Somaliland’s government has little ability to overcome climate change that is directly increasing the incidences of droughts which now occur once every other year compared to once a decade. Nevertheless, Somaliland’s government can work with international partners such as the Food and Agricultural Organization (FAO) and the United Nations to put into place safeguarding arrangements and Early Warning Systems to warn farmers and rural pastoralists of incoming droughts.

6.3 Livestock dependency

Somaliland’s economy is dangerously dependent on livestock production. A key requirement in the future will be export diversification in both products and markets. Somaliland’s high levels of dependence in terms of livestock exports ensures that the entire economy is susceptible to droughts and livestock bans as was the case vis-à-vis Saudi Arabia in the 2000s and as recently as 2016. This economic diversification for Somaliland is necessary to ensure a lower, less volatile current account balance in the future. This is because Somaliland is heavily dependent on one export product (livestock)to one major buyer (Saudi Arabia) and is vulnerable if there are any large falls in its current account balance or if any factor affects either that product or its trade

relationship with its major buyer.

A negative external shock to Somaliland’s livestock sector would not have the large negative effect on macroeconomic stability it currently has if the economy was more diversified. Economic diversification in both exports and output is associated with both an increase in growth and macroeconomic stability and the benefits are particularly large for developing countries such as Somaliland.

6.4 Environmental degradation

Internal and external factors have contributed to the slowdown of Somaliland’s livestock sector. Internally, pastoralists are facing challenges in accessing viable land for grazing mostly due to an increase in land enclosures throughout Somaliland’s regions. Furthermore, the growth of the livestock sector has led to greater environmental degradation as a result of increased charcoal harvesting and general environmental degradation. Researchers have found a correlation between Somaliland’s lack of environmental protection and the increase in cyclical droughts that kill millions of livestock. Protecting trees and biodiversity from charcoal harvesting will have a marked improvement in terms of providing suitable crops for livestock during times of low rainfall.

6.5 Market failures

Somaliland’s livestock sector suffers from market failures which includes the lack of information and limited markets both up/down stream that reduce their owner’s incomes. There are few (or nonexistent) feeder markets to provide animals with nutrition when natural pastures are inadequate.

Livestock herders often sell at times of distress and lack adequate price information. There is little to no insurance provision to support livelihoods during times of drought. Furthermore, the livestock export sector is monopolistic in practice as it is dominated by a few firms leading to a reduction in the price that pastoralists can gain for their livestock.

6.6 Poor state of livestock sector infrastructure

Somaliland’s livestock sector is institutionally weak which includes limited processing and storage facilities as well as transportation methods. This leads to a loss of efficiency and increasing logistical costs which decrease the tax revenues Somaliland’s customs agents can extract from leading exporters of livestock. In addition, Somaliland’s livestock sector requires a government led Early Warning System to warn farmers of risks to their livestock well in advance of cyclical droughts. Neighboring countries such as Ethiopia have adopted Early Warning Systems to ensure the stability of such a critical sector. Somaliland’s government (via the Ministry of Livestock) also needs to improve veterinary service delivery systems, especially in regions such as Awdal, Toghdeer, Sool and Sanaag which are more remote than the capital. Somaliland’s livestock is already considered some of the poorest in terms of quality due to lack of veterinarians across Somaliland.

To ensure greater co-ordination Somaliland’s government should work closely with civil society led organisations. Examples include; associations such as Livestock Export Association, Meat and Milk Association, Somaliland Veterinary Association and the United Livestock Professionals of Somaliland Association. Increased government-civil society collaboration in the livestock sector can lead to better interaction between the businesses community and government.

7 Future Outlook and Opportunities

7.1 Modernisation of Berbera port and the implications of this on Somaliland’s livestock sector

In March 2018, Somaliland, UAE-based DP-World and the Federal Government of Ethiopia signed a tripartite agreement to develop, expand and modernize Berbera port as well as creating the much discussed “Berbera Corridor”. This is a key road that links Ethiopia’s hinterland with Somaliland’s commercial port in Berbera city. The potential multiplier effects of this deal are substantial as landlocked Ethiopia plans to direct at least 30-50% of its export traffic to the closer Berbera port. In addition, DP World will enlarge Berbera port and add extra berths as well as improve the logistical capacity of the port. In March 2018, DP-World and the government of Somaliland also announced the creation of a greenfield, Free Economic Zone around Berbera port. These developments can have a transformative impact on Somaliland’s livestock sector as it can lead to greater efficiency gains, improved productivity and a substantial increase in livestock exports. In addition, the Berbera Free Zone can potentially offer an enhanced business environment for emerging Somaliland livestock-related industries such as hides & skins.

7.2 Employment opportunities

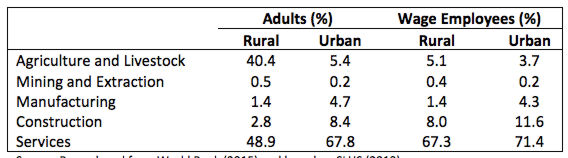

Figure 9: Primary sector of work

(Source: Somaliland National Development Plan 2017-2022)

Somaliland is plagued by a very high unemployment rate, even for the East Africa average. A key issue facing Somaliland’s economy is the high rates of rural-urban migration which leads to the labour force seeking our jobs within the services sector. As a result, creating jobs in the livestock and agriculture sectors are neglected in terms of government policymaking. In rural regions of the country, a large share of the labour force work in the agriculture and livestock sectors whereas in urban centres this figure is as low as 5.4% of adults in urban regions. This is particularly concerning for Somaliland’s government as the agricultural and livestock sectors are considered the most important sectors in Somaliland’s economy as envisioned in the Somaliland National Development Plan 2017-22. In conclusion, Somaliland’s ability to increase productivity in the livestock sector is dependent on creating jobs in the sector and reversing rural-urban migration patterns that place considerable strain on already limited public services in regional capitals such as Hargeisa, Borama and Burao.

7.3 Opportunities for private entrepreneurs to add value

Somaliland’s Diaspora investments in the livestock sector are increasing. More and more, Somalilanders living abroad are returning to invest in their homeland. Often, they are choosing to invest in the livestock sector due to the potential for high returns. Somaliland’s newly-elected government has also paid lip-service to the desire to encourage greater diaspora investment in the sector and as such it is expected that the positive trend of livestock-related Diaspora investments will likely increase.

Another avenue for Somaliland’s government to solicit investment in the livestock sector includes a greater focus on Public Private Partnerships (PPP’s) which act as a strong alternative to other forms of funding. In particular, PPP’s can be used to ensure there is greater investments in regional cities outside the capital Hargeisa. Here, ambitious entrepreneurs can partner with local government to improve the efficiency and productivity of the livestock sector in their respective regions. Nevertheless, for PPP’s to succeed there is a strong need for formulating policy and regulatory frameworks for the PPP implementation

and reviewing current PPP structures and management practices.